Bobby T 95 percent owner would like to elect S corporation status for DJ Inc but Dallas 5 percent owner does not want to elect S corporation status. But there are several tax brackets and as youve probably heard a number of ways to limit your corporate tax liability.

S Corp Vs Llc Difference Between Llc And S Corp Truic

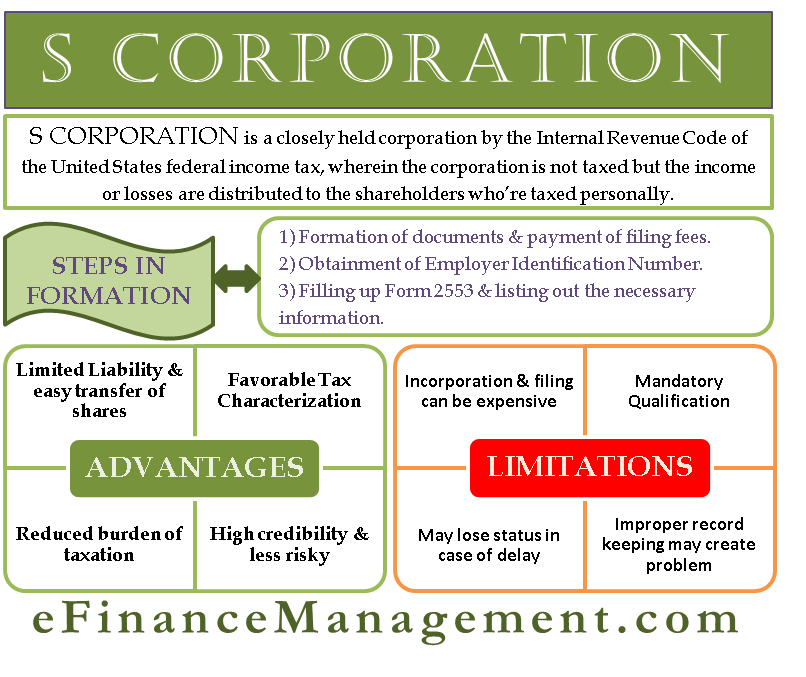

An S-Corp Election is a tax-related filing.

. It simply informs the federal tax authorities the amount of net profitloss made by the S Corporation the shareholders amongst which the profitloss will be distributed and the proportion. This all means that depending on which states and localities tax laws apply a corporation may end up paying between 35 and 56 tax on its net income. To qualify for S corporation status the corporation must meet the following requirements.

When the S-Corp tax election is made the entity is telling the IRS that it would like to be taxed as a partnership rather than as a corporation. True False 7 The two kinds of stock issued by corporations are common stock and dividend stock. If a corporation can qualify for treatment as.

An S Corporation is like any other corporation formed under state law except the shareholders have elected to treat it as flow through entity for federal tax purposes. The S-Corp will not be taxed as an entity because the shareholders will have to report their percentage of income or losses regardless if the corporation passed a dividend. Section 1 Quiz 1 Renewable resources include soil fresh water wild animals and A.

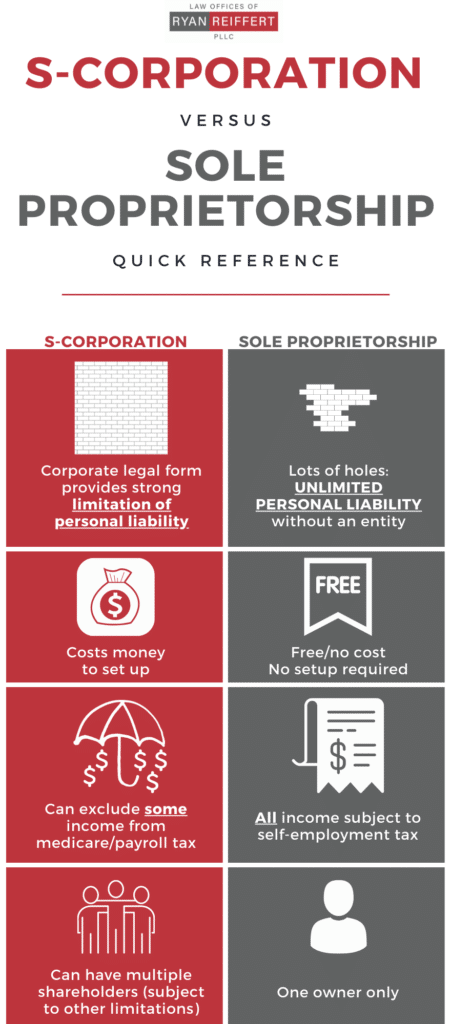

Meaning the loss can offset any other income that you received. -Wages paid are subject to employment taxes 153 total-Any S corp profits in excess of reasonable compensation are not subject to employment taxes. S-Corps have pass-through taxation status.

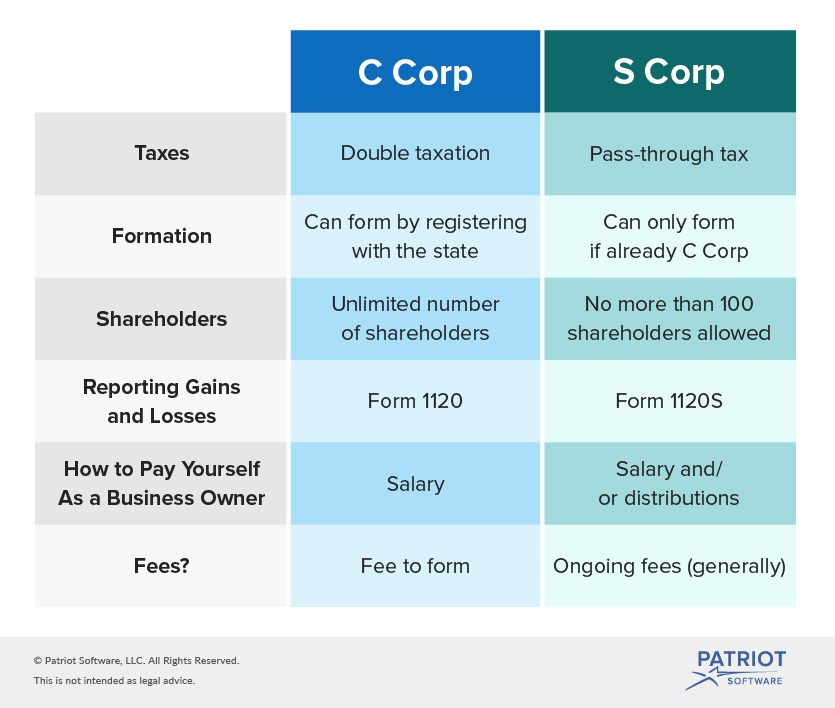

It simply informs the federal tax authorities the amount of net profitloss made by the S. The tax rate for most C corporations is between 12 and 28 percent. Federal corporate tax rates rates can reach 35 percent.

Tax professionals will also be able to file S corp extensions by utilizing tax applications. Low Risk of Audit. Typically the S Corporation files its annual return using the Form 1120S as opposed to the 1120 for a C Corporation.

All of the corporate income losses deductions and taxes are paid by the shareholders rather than by the corporation itself. May be individuals certain trusts and estates and. Lastly you can also choose to file an S corp tax extension by printing out Form 7004 filling it in and posting it to the IRS.

Before we dive into the tax benefits of S-Corps first just keep in mind that S-Corporation status is a tax designation so you cant incorporate as an S corp but you can elect to be taxed as one. This is just like an LLC or Partnership. While a corporation is a type of business entity an S-corp is a tax designation available to certain corporations and LLCs.

Have only allowable shareholders. Section 1368 notes the distribution by an S corporation of property or cash may result in three distinct tax consequences to the shareholder receiving the distribution. If your letter is held up in the post this can cause delays in the.

True False 9 An acquisition occurs when one company purchases another company by buying most of its. Just like in an S corp profits in an LLC pass directly to the members and are taxed as personal income. S-corps are named from the subchapter of the Internal Revenue Code.

In an S corp the owners salary is considered a business expense just like paying any other employee. Be aware however that this method can be very slow. This means any business that operates as an S corporation also offers limited liability protection just like any other LLC or corporation would.

Local and state taxes can raise the marginal corporate tax rate to 39 percent. True False 8 An S corporation is taxed just like any other corporation. Any net profit thats not used to pay owner salaries or taken out in a draw is taxed at the corporate tax rate which is usually lower than the personal income tax rate.

In other words LLCs dont really gain any benefit from an S corps pass-through entity status. The selling of the stock may result in capital gains. S corps are pass-through tax entities.

An S corporation is type of business entity that functions like a corporation but is taxed like a partnership. Using the specific identification allocation method how much. Wood Stain And Protector Colour Chart Protek Wood Stain Staining Wood Paint Color Chart Shed Paint Colours Can be time-consuming and may require changing established practices Section 1 Review Explain the importance of managing specific.

For example if the profits of the S corp are 100000 and there are four shareholders each with a 14 share each shareholder would pay taxes on 25000 in. The S corp tax designation allows corporations to avoid double taxation. In fact the S corp tax status can only be elected by an LLC or corporation.

This is before any dividends to stockholders which would then also be taxable to those stockholders and not deductible for the corporation. Like the S-corp it gets its name from the subchapter of the Internal Revenue Code under which its. An LLC offers a more formal business structure than a sole proprietorship or partnership.

When creating an S corporation which is an option for corporations with fewer than 100 shareholders the owner must charter the business. This is different from a sole proprietorship where all net profit. An S corporation S corp is an IRS tax status that incorporated businesses like LLCs and corporations can elect.

S corporations are responsible for tax on certain built-in gains and passive income at the entity level. As CEO and founder of Carls Sandwiches you earned a 60000 salary in 2019 and the company also earned a net profit of 200000 that year which youre entitled to 50 ofor 100000. How S Corporation Owners areTaxed.

Since 2010 S-Corp audits have. The owners of the S corp pay income taxes based on their distributive share of ownership and these taxes are reported on their individual Form 1040. For purposes of federal taxation an S Corporation is taxed differently than a C Corporation.

Be a domestic corporation. 6 The assets and liabilities of a corporation are separate from its owners. A C-corp is the most common corporate tax status.

The 1120S is an informational return. A tax-free reduction of the shareholders stock basis. The 1120S is an informational return.

Corporations taxed as S corporations offer the same legal protection to owners as corporations taxed as C corporations. Because Carls Sandwiches is an S corp youll only have to pay self-employment tax on the 60000 salary and not on the 100000 distribution. Lastly one of the biggest and most notable differences is the S-Corps tax structure.

Give examples in your explanations. SELF EMPLOYMENT TAX. Many people think that an S-Corporation is a type of corporation but really an S-Corporation is a C-Corporation with an S-Corporation tax election.

Typically the S Corporation files its annual return using the Form 1120S as opposed to the 1120 for a C Corporation. While LLCs and S corporations two terms are often discussed side-by-side they actually refer to different.

What Is The Difference Between S Corp And C Corp Business Overview

S Corporation Tax Reduction And Liability Protection For Small Business Ryan Reiffert Pllc

S Corporation Meaning Formation Features Criteria Pros Cons Etc

0 Comments